If you’re a business owner and want to start thinking about selling your business or retiring, you need to take into account that it can be a long process – from making the decision to sell/ retire one day to fully exiting from your business.

Here’s a guide on common business exit strategies and what to consider when planning your exit.

Are you interested in getting help with a merger or acquisition? Contact Clare Advisors today to get started!

Why Should You Have a Business Exit Strategy?

Developing a business exit strategy allows you to plan how you will eventually separate from your business and helps ease the transition. Without a doubt, the process of selling, exiting, or retiring can be emotional and overwhelming. The earlier you decide your exit strategy from your company, regardless of what type of plan you choose, the more prepared you will be when the time comes.

Below are some common business exit strategies:

- Liquidating the business

- Internal sale to key employees

- Selling to a third party

Do you want to exit your business through a sale, where you will continue working with it throughout an earnout period before eventually exiting? Do you want to sell it to some of your key employees? Or do you just want to permanently leave your business, whether it’s at the end of your career or liquidating it to do something else?

Liquidating the Business

Depending on your unique wants and needs, any one of the above exit strategies may work for you. If you decide to retire, you may liquidate the business once you no longer want to run it anymore.

If you liquidate your business, you can keep all the cash on the balance sheet, but you will have to terminate all your employees and possibly pay severance. Additionally, you may either stop doing work for your clients, or you can complete all your contracts and not take on any new work (which can sometimes be a complicated transition process).

Internal Sale to Key Employees

Before you decide that you will just sell your business to key employees, you want to make sure you have employees that have both the means and risk appetite to buy your agency. If none of your employees have ever asked for any type of ownership stake in your business or for more responsibilities/ roles within your company, there is a lower probability that key employees will ultimately acquire the company from you.

If you do have employees who have expressed interest in acquiring your agency, you should put together a business plan with them (including buyout structure) that will prepare them to successfully take over operations and financials once you exit.

However, while some key employees may have the risk appetite to purchase a business, they may not have the means to buy the business from you at a market price. If the key employees are willing to take out loans and / or you are willing to discount the agency, an internal sale is possible.

Selling to a Third Party

Many owners like the idea of selling to a larger company for a lump sum and fully exiting their agency once the deal closes. However, not only can the selling process can be lengthy and time-consuming, but buyers rarely pay for a company with cash up front with no earnout. Accordingly, for business owners wanting to sell their company by a certain point, a business exit plan needs to be put in place, and the deal solidified often years before the owner wants to fully exit.

An exit plan will allow you to:

- Get the most out of your company — both when you’re running it and during a potential earnout

- Ensure continuity of your brand and its reputation

- Have continued employment for your staff

It will also help you properly evaluate your business and provide more opportunities to optimize business outcomes. Planning your business strategy sooner rather than later allows you grow and streamline your agency, go through a sale process, and finish your earnout without having to worry about what will happen to your business and employees when you eventually exit.

Whether you’re doing a traditional sale, limited sale, or exclusive negotiation, you want to consider the different lengths of time for a sale transaction. Depending on the needs and wants of both parties, a sale process can take anywhere from a month to a year to complete.

A common misconception many owners have is that they need to wait until their agency gets “big enough” to sell. Business owners can maximize their earnout and overall valuation by selling their company at the beginning of expected revenue and profitability growth. Giving yourself time to streamline your operations and financials in preparation for the transaction will make for an easier sale process.

When to Start Planning Your Business Exit Strategy

If you don’t have any exit plans in place years in advance well before you retire/ exit your business, it may be too late to consider a viable M&A sale. Additionally, if you don’t have employees that want to buy your company from you, you may have to liquidate the business.

Are you interested in how you should start planning your business exit strategy? Contact Clare Advisors to learn more!

What Should You Include in Your Business Exit Strategy?

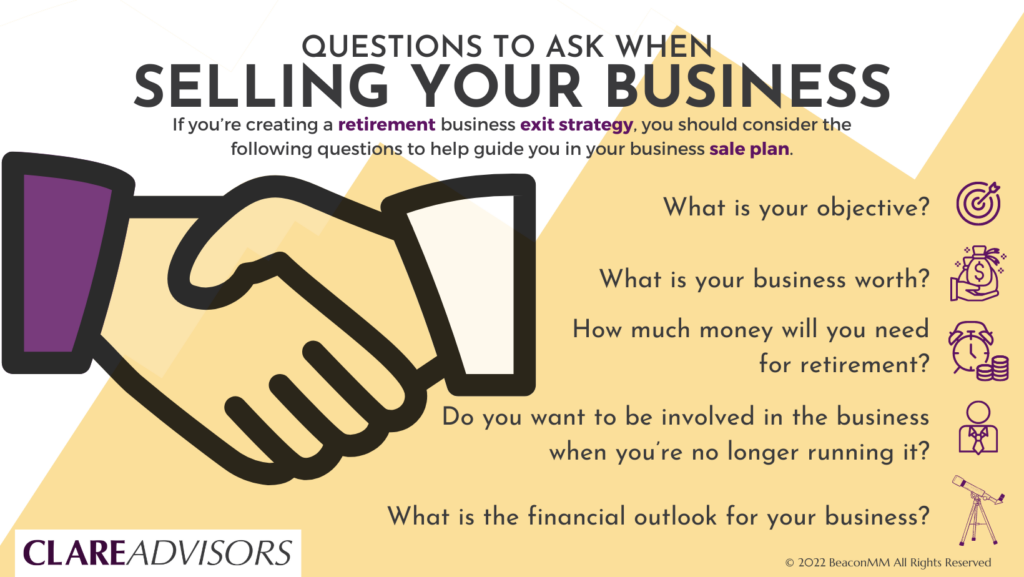

When you first create an exit plan, you should yourself (and key employees if you are considering an internal sale) some questions to help guide you in your plan-making process:

- What is your objective? This revolves around the type of exit you want and what you want out of it for you, your business, and your employees.

- What is the business worth? A question like this will help you preliminarily value your business and decide where you want to stand financially when you exit.

- How much money will you want at the end of your sale or liquidation? This can help you understand what business decisions need to be made to ensure appropriate profitability growth.

- How involved do you want to be once you’re no longer running it? If you decide to sell to a third party, you may choose to continue working with the buyer past your earnout. This can be a new role or in another department.

- What is the financial outlook for your business? Depending on the projected profitability, you should adjust accordingly up to your exit to ensure the maximized profit.

Asking yourself these questions can help guide you in what direction you’d like to take the agency and help you become more comfortable with the idea of eventually letting go of something you put years of effort and time into.

How Can Clare Advisors Help You?

Creating an exit strategy that considers your wants and needs, and the company’s and employees’ futures can be difficult. With the help of an M&A advisor, you can receive guidance throughout the entire process.

If you’re considering retiring from/ selling your agency, you should consider speaking with our M&A professionals to ensure that you have a general idea of what to expect given the exit strategy you choose for yourself, your company, and your employees.

Are you ready to start planning your retirement business exit strategy? Schedule a consultation with Clare Advisors today!