Are you trying to sell your marketing or advertising agency but are not sure how an earnout works? Negotiating an earnout structure that works for both you and the buyer will help ensure both parties benefit after the transaction closes. Working alongside our M&A advisors team at Clare Advisors is a great way to get help you move forward through the process.

Would you like assistance with your earnout structure? Contact Clare Advisors to get started.

What Is An Earnout?

An earnout is a provision written into a transaction structure that provides from conditional payments from a buyer to the seller in which a portion of the overall purchase price is paid out. Typically, it’s contingent upon achieving pre-defined financial thresholds or operating milestones post-transaction. Although not every deal structure will include an earnout, it is fairly common in the advertising and marketing industry.

If you’re interested in selling your firm, you’ll want to sell when you have the most potential for growth in your earnout period. The more momentum you have for an upswing in revenue and profit, the more you can benefit post-closing. Earnouts allow both buyers and sellers to take advantage of expected growth in the acquired agency.

Why Would An Earnout Structure Be Needed?

Having an earnout structure in place decreases a significant amount of financial and operational risk for the buyer after they acquire an agency. When negotiating the sale of your agency, one of the most significant issues is the value of your business compared to what the buyer sees.

Buyers typically look at the historical financials, where the agency financially stands at the time of acquisition and expected financials. While the buyer can also look at the seller’s operations and procedures during due diligence, it is difficult to precisely predict well the agency will perform in the coming years. As buyers generally do not want to pay the entire purchase price at closing, most buyers will have some form of earnout structure in a deal.

On the other hand, since agencies typically need to meet a given milestone, the seller earns a higher earnout payment(s) if the agency performs better than the minimum expected performance. Accordingly, both parties are incentivized to have the acquired agency’s profitability increase each earnout year.

An earnout structure allows you and the buyer to evaluate the agency for its future profitability properly. An M&A advisor can help both parties assess the value of your agency and help you sell it at an appropriate cost with an appropriate structure.

What Is the Most Common Type of Earnout?

Earnout structures depend entirely on what the buyer and seller are looking for. There is no “one size fits all,” but there is a common way to structure earnouts. An EBITDA-based (Earnings Before Interest, Taxes, Depreciation, and Amortization) earnout is based on the profitability of the selling agency after it is acquired.

Due to the flexible nature of an EBITDA-based earnout, buyers and sellers can work closely to align their cultural, financial, and operational needs.

With a profit-based earnout structure, the selling party is financially incentivized to meet agreed upon profit milestones to receive additional payments beyond the closing payment. Typically, the profit milestones are based upon the selling agency’s prior and expected profitability. For example, if your profitability increases by a consistent ten percent every year, a buyer would expect the same going forward. Evaluating your historical revenue and profitability, as well as expected revenue and profitability in the coming months and/or years, allows you and your buyer to gauge the future financial milestones as accurately as possible.

For example, an earnout can be structured to have 50% acquired at closing and the second 50% acquired at the end of the earnout period. An earnout structure like this allows your agency to be revalued at the end of your earnout period. If it has grown, the buyer typically values the second half of the agency at a higher multiple based upon an average of EBITDA throughout the earnout period.

Stub Payments

The closing payment is often one of the most negotiated points in a transaction. The seller typically wants as much consideration as possible upfront. The buyer wants to financially de-risk the deal by spreading out the overall purchase price consideration and putting more weight on the earnout portion.

If you and a buyer have difficulty reaching an agreement regarding the closing payment, both parties may opt for an agreed upon supplemental (stub) payment that will be paid later. Stub payments are not as common in every transaction but they do occur and can be paid alongside earnout payments.

Are you interested in how to properly assess the value of your agency? Contact Clare Advisors to learn more.

What Is the Typical Earnout Period?

An earnout period is the time period in which an earnout takes place and depends on the terms agreed upon by the buyer and seller. Even though every deal is little different, an earnout period typically ranges between three to five years in the advertising and marketing industry.

Depending on the individual needs of the buyer and seller and the circumstances surrounding the deal, the earnout period can be shorter or longer.

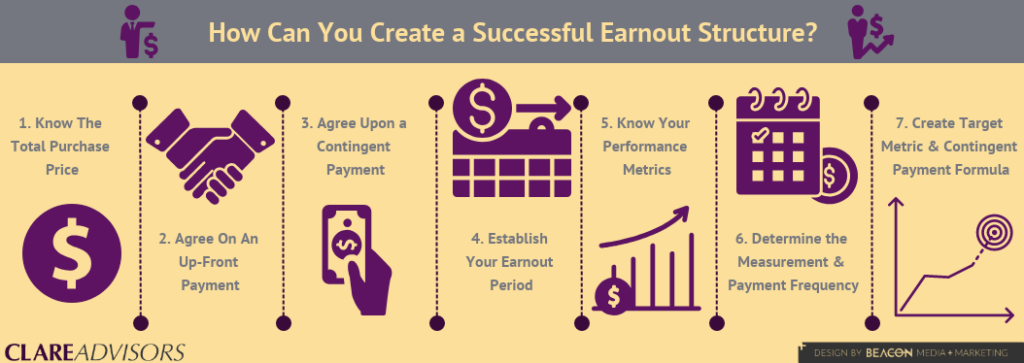

How Can You Create a Successful Earnout Structure?

As stated previously, there are many ways to structure an earnout that will benefit you and the buyer. As you navigate through a sale transaction, you should consider a few key elements when negotiating an earnout that works best for you and the buyer.

1. Establish Your Earnout Period

Your earnout period will probably land between three to five years for your marketing, advertising, or PR firm. The seller and buyer need to understand the appropriated time given to “earn” additional payments.

2. Know Your Performance Metrics

You need to know your agreed upon performance metrics to ensure that each stage is well understood, clearly defined, and easily measurable. This will make it easier for you and the buyer to see the progression of growth in your agency in a qualitative way.

3. Determine the Measurement and Payment Frequency

There should be an agreed upon the payment method that includes a multiple staged payment method or a single payment typically made at the end of the earnout period. This sets expectations of when the seller can expect to get paid if the financial milestones are met.

4. Create Target Metric And Contingent Payment Formula

A target metric reflects the level of financial performance and its corresponding payment amount for the given level of performance.

M&A Advisory Services For Your Earnout

Clare Advisors is an M&A advisory firm with decades of experience in mergers and acquisitions in the marketing and advertising industry.

Our team will provide you with advice from the time you decided to sell your agency to the day you sign the purchase agreement. With our advisory team guiding you through the sell-side M&A process, you will be able to negotiate an earnout structure that benefits you.

Are you searching for an M&A advisor to help with your earnout structure? If so, contact Clare Advisors for expert advisory services.