Selling your business can be an exciting time with new opportunities for you and your business. You may expect to decide to sell and then sign on the dotted line in a few months, but there are many moving parts that affect the sale process. It is nearly impossible to predict the exact day a transaction will be completed, considering each varying factor that plays its own role in the timeline.

Are you interested in getting help with selling your business? Contact Clare Advisors today to learn how we can help you!

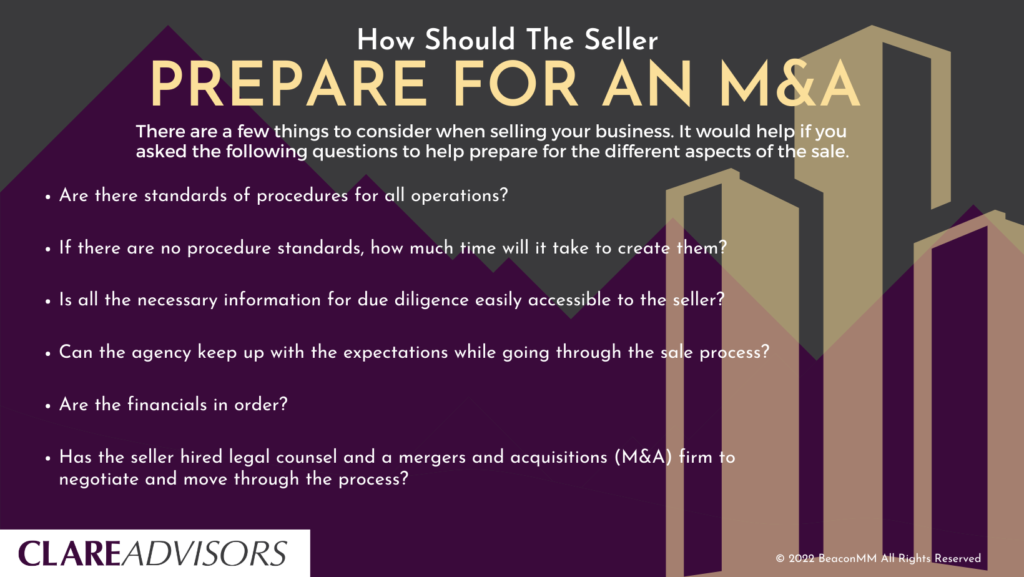

Seller Preparedness

One major variable that plays a big role in the speed at which the transaction timeline progresses is the preparedness of the seller and their agency. As a seller, you may know that you’d like to sell your business, but have you set it up financially, culturally, and operationally to run successfully without you at the helm? Are you adequately prepared to go through the sell-side process?

You should ask yourself the following questions to gauge your preparedness for a transaction:

- Are there standards of procedures (SOPs) for all operations?

- If there aren’t any SOPs, how much time will it take to establish them / get them in writing?

- Is all the necessary information for the due diligence process easily accessible to you?

- Balance sheets

- Income statements

- Revenue by client

- Revenue by service

- Tax returns

- Corporate records, etc.

- If not, how do you anticipate pulling together all of the information without alerting your staff of the transaction before you are ready to tell them?

- Can the agency keep up with the expectations while going through the sale process?

- Have you hired legal counsel and a mergers and acquisitions (M&A) firm to help you move through the process?

Having organized records and financials is important for any sale, but it can also be a great benefit to you and your company on a monthly and annual basis as well. Monthly financial reports can give you a general idea of your agency’s growth, cycles, and potential momentum going into the next fiscal year, or in the case of a sale transaction, the next earnout year.

Buyer Preparedness?

Another thing that could change the transaction timeline is how prepared the buyer is. If they are not internally prepared to acquire your company, this can lengthen the time it will take for them to put forth letters of intent, other transaction documents, and negotiate them in a timely fashion.

Some questions that you can ask to help ensure that you’re selling your agency to the right buyer may include some of the following:

- Have they acquired agencies before?

- If so, does their acquisition process and transaction structure remain the same with all their acquisitions?

- Do they offer a set percentage of the overall purchase consideration at closing?

- How long do their acquisitions normally take?

- Do they have an integration plan?

- Have they already hired legal counsel and an M&A firm that can draft and negotiate the LOI, purchase, and employment agreements?

A buyer needs to be as prepared as the seller is for a transaction. Buyers that have acquired before may already have a standard NDA, LOI, due diligence request list, and purchase agreement that they may customize for each transaction. This can be a benefit from a process standpoint, as they already know what it expected and when.

Are you interested in a buy-side transaction? Clare Advisors can also help with a new endeavor after you’ve left your company!

Preparedness of Both Parties

Both selling and buying parties should be prepared for the process. Additionally, both parties should be prepared to compose, receive, review, redline, and send back transaction documents in a somewhat timely fashion. Due diligence and purchase and employment agreement negotiations can take months depending on how long each side takes with each document. Parties should consider putting together a gantt chart that covers the entire timeline to better set expectations from each side. If both sides know in advance when things are expected to hit their desks, they can allocate the appropriate amount of time to react accordingly.

Both sides need to have internal conversations to discuss the following:

- How quickly each side can make their points or redlines during negotiations

- How efficiently can the seller provide and the buyer review the necessary information in due diligence

- How many people will legal counsel need to have looking at the due diligence materials

- Is there a designated team to work on the transaction?

Both parties will need to be able to agree on major points like the earnout structure, the cash at closing, the working capital that will transfer with the business, etc. With so many points to negotiate, it is in everyone’s best interest to not have each party take over two weeks to review, redline and send a document back. Naturally, M&A advisors help facilitate the process and ensure that the process moves along as efficiently as possible under the circumstances.

Time of Year

Although both parties’ levels of preparedness significant factors that can affect an M&A timeline, when you try to sell your business can also affect the timeline. The marketing and advertising industry, as well as the M&A industry, tends to slow down or be very active at certain points of the calendar year. Depending on when the selling or buying process falls in the year, this can make it more difficult to move through the process as quickly as both parties would like.

Generally speaking, many people tend to be busier at the end of the year. The last few calendar months are also more hectic for legal and tax counsel. Accordingly, buyers and sellers should aim to close deals around periods when all parties are as available as possible.

Even for your legal counsel and M&A advisor(s), selling your business at the right time can help ensure that your deal is getting an appropriate level of attention and effort from all related parties.

How Can an M&A Advisor Help with the Sell-Side Process?

Hiring a trustworthy and efficient M&A advisor for your sell-side transaction can be one of the best investments that you can make during your deal. Working with an M&A advisor allows you to get the best-negotiated price for your business, favorable terms, and helps you move through the process in as timely of a fashion as possible.

Clare Advisors has been providing M&A advisory services for decades in the marketing and advertising industry. They can help through every step of the process, from helping you create an exit plan, to closing day. If you’re considering hiring an M&A advisor that will help ensure that every detail is looked over, connect with us today!

Are you ready to see how an M&A advisor can transform your sell-side transaction? Contact Clare Advisors today to see how our team can help you get the best from your M&A deal!